Supply chain price increases and bottlenecks lead to negative first six months for tractor registrations in 2022

PRESS RELEASE

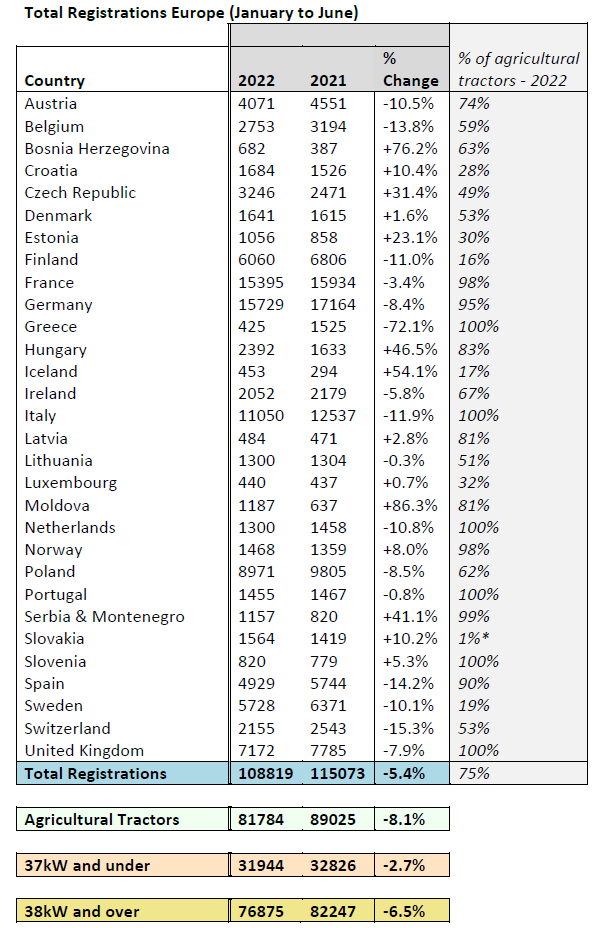

Business climate improving following sharp decline

Brussels, 22nd September 2022 - Overall, some 108,800 tractors were registered across Europe[1] in the first six months of 2022, according to numbers sourced from national authorities. Of these registrations, 31,900 tractors had an engine power of 37kW (50 hp) and under and 76,900 of 38kW and above. CEMA considers that 81,800 of these vehicles are agricultural tractors. The rest are made up of a variety of vehicles which are sometimes classified as tractors, which includes quad bikes, side-by-sides, telehandlers or other equipment. An overview of the total tractor registrations can be found in the annex, including an indication of the proportion of registrations in each country which can be classified as agricultural tractors.

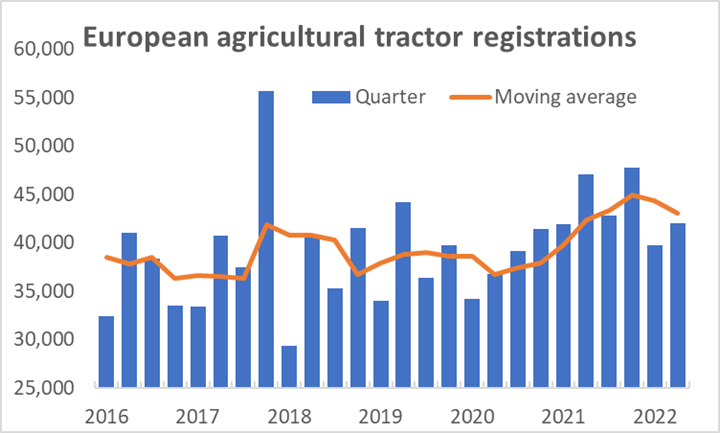

Agricultural tractor registrations for the first semester decreased by 8.1%, compared with the opening six months of 2021. The number of machines registered in each month of the year to date has been lower than a year before. However, while the year started almost on a par with 2021 for January 2022 (-2% vs 01/21) and February 2022 (-5%), further disruptions linked to the current geopolitical situation added their impact and registrations declined more sharply in March (-7%), April (-12%), May (-5%) and June (-15%). As the first half of 2021 saw unusually strong registrations, a decline was perhaps to be expected and the number of agricultural tractors registered in the first half of 2022 was still the second highest in at least eight years.

Chart 1 - Source Systematics International, formatted by CEMA

Chart 1 - Source Systematics International, formatted by CEMA

Concerns remain with continuing production delays; energy reduction plans create additional uncertainty

The number of tractors registered in Europe during the first semester of 2022 would no doubt have been even higher were it not for continuing disruption to global supply chains. These are mainly due to the long-term impact of the Covid-19 pandemic but have been made worse after February 2022 due to the current geopolitical situation. These disruptions have led to both bottlenecks in the supply of raw materials and components to manufacturers and price increases for those same goods.

Additional concerns are reported over the possible impact of measures aimed at preparing Europe for potential future energy supply disruptions and high prices: these could have a very significant impact on our industry and on our supply base.

Surging agricultural commodity prices but uncertainty ahead

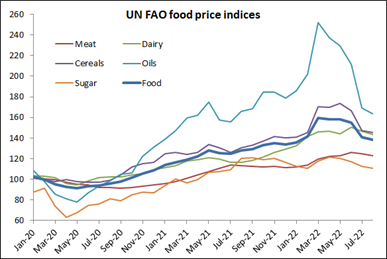

During the last months demand for tractors and other agricultural machinery in Europe remains robust, helped by strong agricultural prices which according to the global food price index published by the United Nations Food & Agriculture Organisation (UN FAO), reached unprecedented levels earlier in the year. Nevertheless, at the same time, farmers were also challenged with a similar unprecedented rise in prices for some key inputs, such as fuel, fertiliser and animal feed. With prices likely to remain volatile for some time, the future of farm incomes is highly uncertain, despite temporary derogations and support schemes proposed at European and National levels.

Chart 2 - Source UN FAO, formatted by CEMA

Chart 2 - Source UN FAO, formatted by CEMA

Registrations drop not equal across the whole tractor power range

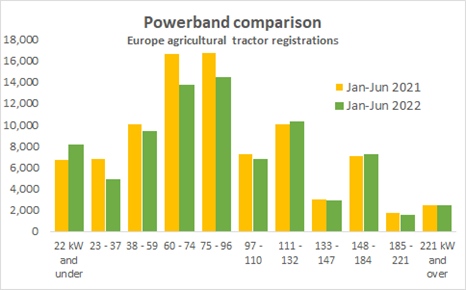

Agricultural tractor registrations in January to June 2022 were on a par with or lower than the same months of 2021 across most of the power range, except for the smallest machines (22kW and under). The biggest falls were for machines between 23kW and 96kW; over half of tractors registered were in this power range but registrations declined by 16% between 2021 and 2022. For tractors with powers of 97kW and above, registrations were only 2% lower than a year ago.

Given the supply chain disruptions, these trends might reflect availability of machines as much as demand for them.

Chart 3 - Source Systematics International, formatted by CEMA

Chart 3 - Source Systematics International, formatted by CEMA

Significant country differences remain across Europe

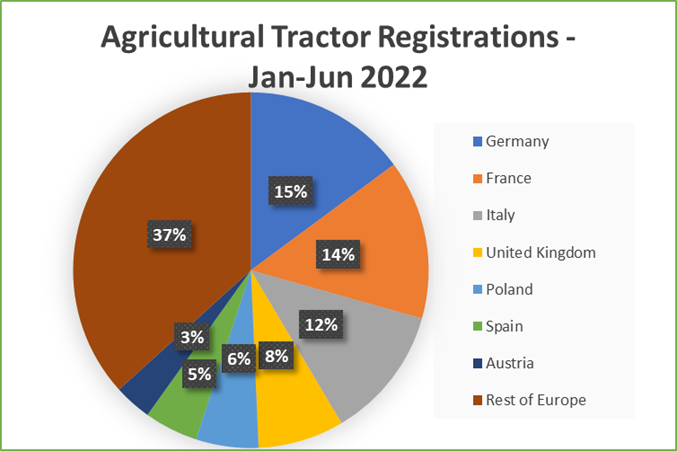

Agricultural tractor registrations declined in each of the seven largest European markets but they still accounted for over six in every ten tractors registered in Europe. The two biggest agricultural tractor markets in Europe remain France and Germany (Graph 4), with those two countries accounting for almost 30% of all tractors registered in Europe in the opening six months of 2022. Registrations in these two countries fell by 7% and 5%, respectively. Italy, Poland and Spain, all of which saw very high registrations in 2021, have recorded faster declines so far in 2022. Only a few countries, mainly in Eastern Europe, registered more agricultural tractors than a year before.

Chart 4 - Source Systematics International, formatted by CEMA

Chart 4 - Source Systematics International, formatted by CEMA

In reviewing the Registration numbers across Europe, economic experts from CEMA national associations further commented:

In Germany, tractor registrations in the first half of 2022 were down 7% on the same period of 2021. However, that is compared to a high base, as last year was a year of strong growth overall. The lower power classes showed the strongest growth last year and are correspondingly more clearly in the minus this year. In contrast, there was actually a 2% increase in the power classes above 150 HP from January to June 2022, compared with the previous year.

In France, first-time tractor registrations were down -3% in the first half of 2022, compared with the same period last year. However, they are well above the average for the last five years, as 2021 was exceptional in terms of investment in agricultural equipment. After a good first quarter, new tractor registrations began to decline in April. Supply and delivery difficulties certainly had a negative impact on the volume of registrations, although it is not clear to what extent. In detail, registrations of landscape tractors continued to grow, while standard tractors and vineyard and orchard tractors were down by around 5%

In Italy, in the first half of the year, the agricultural machinery market confirmed high sales volumes, albeit lower than the record levels reached in 2021. The registration figures indicate in fact, in the period from January to June, a 12% decline for tractors, with 11,050 units registered, a number that remains above the average of the last four years. The contraction in sales observed between January and June was not due to a drop in demand, which, on the contrary, continued to be sustained. Instead, the market downturn was mainly caused by problems in the supply chain. The sector is therefore confirmed to be in good health, although the remainder of the year could be conditioned by the variables related to the cost of raw materials and the developments in the geopolitical landscape.

In the United Kingdom, tractor registrations in the first half of 2022 were down 6% on the same period of 2021. However, strong growth was reported last year and the total for January to June 2022 was still 6% above the average for the time of year over the previous five years. These results are encouraging, given the significant challenges which manufacturers are facing due to shortages of key components and raw materials. Orders for tractors and other types of farm equipment remain very strong - the problem is getting the machines to end customers. Average delivery lead times for tractors remain over six months, while it is taking even longer to get other mobile machinery, such as harvesters, to their end user. The extended pipeline of orders means tractor registrations should remain strong for some time to come, even if orders do start to slow down.

In Spain, total tractor registrations dropped by 14% in the first half of 2022. The six-month changes by type of tractors are: -14% for standard, -19% for narrow track (NTT) and +15% for ATVs and ATUs (though this figure is even higher when accounting for units not registered as agricultural but used on farms). The price index of tractors increased by four percentage points in the first quarter, according to EUROSTAT, while imports were down 3% (>18 kw) and up 7% (total market). Therefore, the increasing number of low HP tractors used in specialty crops in Spain – which lowers the actual tractor price index and increases the total imports numbers – is directly competing with NTTs. Demand drivers are behaving negatively in recent months (high prices of energy, fertilizers and animal feed), and weather conditions during the second quarter have caused a strong decrease of crops yields which will hardly be offset by commodity prices. The general mood of farmers is down due to macroeconomic perspectives offering a difficult scenario for the market, even if agriculture drivers improve in the second half of the year.

In Poland, in the first half of this year, 5,598 new agricultural tractors were registered and this is a worse result than in the corresponding period of 2021, with a decrease by 14% compared with last year. The number of registrations is not a big surprise as the previous two years were very good for the industry, especially 2021, when over 14,000 new tractors were registered. After such a good period, it was expected that there would be a correction in the market. The data for the first half of the year confirm this. In contrast, 4,420 new agricultural trailers were registered in the first six months of this year, 295 more than last year. This result means an increase by 7%. Following the increases in the tractor market over the past two years, it was expected that accompanying machinery would also experience increases. The tractor on the farm is usually the first investment, followed by farmers investing in other equipment.

In Belgium, tractor registrations in the first half of 2022 were down 14% on the same period of 2021. The total for tractor registrations for January to June 2021 was the highest in the last five years. Almost two-thirds of the tractor registrations in Belgium are tractors of more than 50 hp.

In the Netherlands, farmers are experiencing serious uncertainties related to perspectives for agriculture due to new sustainability goals and the actual drought. This had an impact on tractor sales, with a drop of 10% in registrations, and the order intake shows a drop of 15%. The mid-term outlook needs a new confidence pillar to restore the mood of Dutch farmers.

In the first half of 2022, the Austrian tractor market remained at a very high level but was slightly down compared to the record year of 2021. The level of the first half of 2022 is almost 24% higher than the last pre-Covid year, 2019. Manufacturers continue to face major challenges with their supply chain and the availability of parts needed to manufacture tractors. In addition, the prices of upstream suppliers and input materials continue to rise.

In Turkey, agricultural tractor registrations for the half year 2022, decreasing by 8%, in comparison with 2021. During this period, 29,577 tractors were registered and the rate of change was 20%, compared with the average of the last 5 years. Despite the high inflation in Turkey, very low (subsidized) loan rates for tractors had a positive impact on demand. The continuous upward trend in inflation accelerated the demand. However, the decrease in purchasing power due to very high inflation and the need for much higher working capital of farmers affected demand negatively. Of course, there are also still problems in the supply chain in tractor production.

Business climate stable

The latest CEMA Barometer shows that general business climate index for the agricultural machinery industry in Europe has broadly continued its sideways movement at a positive level after the sharp declines in the course of the Russian war against Ukraine. In September, the index dropped back slightly to the level of June, ending up again at 13 points (on a scale of -100 to +100).

The European industry representatives have maintained their turnover outlook for the full year 2022 almost unchanged at a plus of around 5% and forecast further slight turnover growth on average for 2023, albeit only in the low single-digit range.

Price increases and bottlenecks on the supplier side continue to challenge the industry, but some slight easing is observable. Currently, 31% of the companies are planning a temporary production stop due to shortages in the coming four weeks.

The regional breakdown on the market side shows decreasing confidence levels for some, mainly larger, European markets. According to the survey participants, moreover, the need for investment in almost all end customer markets, except in Romania and Eastern Europe, seems to have become somewhat exhausted.

– ENDS –

Annex:

* Data received from Slovakia contains a large number of machines whose status could not be determined, so the percentage of agricultural tractors is not an accurate reflection of numbers

Source: Systematics International, formatted by CEMA

Disclaimer: the total number of registrations may include other types of vehicles such as telehandlers and ATVs. Additionally, for certain countries it can include some second-hand registrations. This is still the best data set available to CEMA sourced from national authorities.

[1] Figures cover most EU markets and some non-EU countries. See Annex for full list of countries included.